The flat landing is what every legislator dreams of when the market gets bubbly, and what every real estate spokesperson claims we are in as markets decline.

It's something we have some experience with here in Victoria, since it is widely known that our last correction turned out to be this flat landing for the better part of a decade while wages, interest rates, and housing policy caught up to inflated prices.

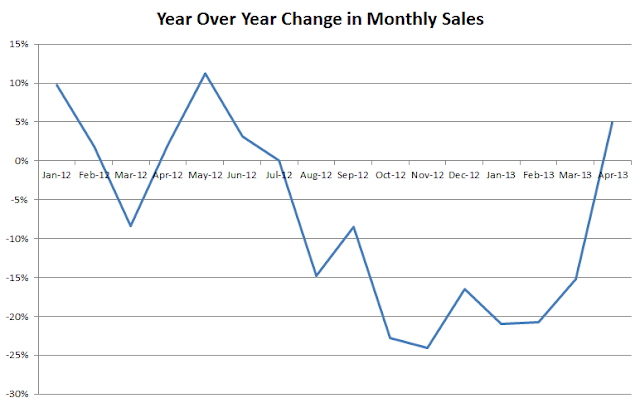

But how flat do prices have to actually be before we can call them flat? Our resident halibuts have a heavy hand on the straightedge, and tend to call anything within ~10% of peak flat enough to pour the foundations on. I've been measuring decline from peak based on the 3 month smoothed median, by which prices are down

about 10% so far.

So how flat was the correction in the 90s really? Well from our current lofty vantage point, it looks pretty flat.

What if we apply our same 3 month median measure?

Clearly detached homes fared the best, with peak drop only 12%, and values mostly hovering at less than 10% under peak for 7 years. Condos got a worse deal. Hit with a double whammy of the correction and the leaky condo scandal, they continued to decline to a peak drop of over 25%. That might kick them out of the flat landing category.

If we're going by percentage corrections, then we're still currently within the realms of a flat landing. Of course in the end it's all about the money. 10% in 1994 was only some $20,000 ($29,000 in today's money), while 10% today is over $55,000. So in percentage terms we might still be in flat landing territory, but in terms of lost dollars, we are already beyond our previous correction.